Your How do i get a ifta sticker images are available in this site. How do i get a ifta sticker are a topic that is being searched for and liked by netizens now. You can Find and Download the How do i get a ifta sticker files here. Download all free images.

If you’re searching for how do i get a ifta sticker images information connected with to the how do i get a ifta sticker interest, you have visit the ideal site. Our site always provides you with hints for viewing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

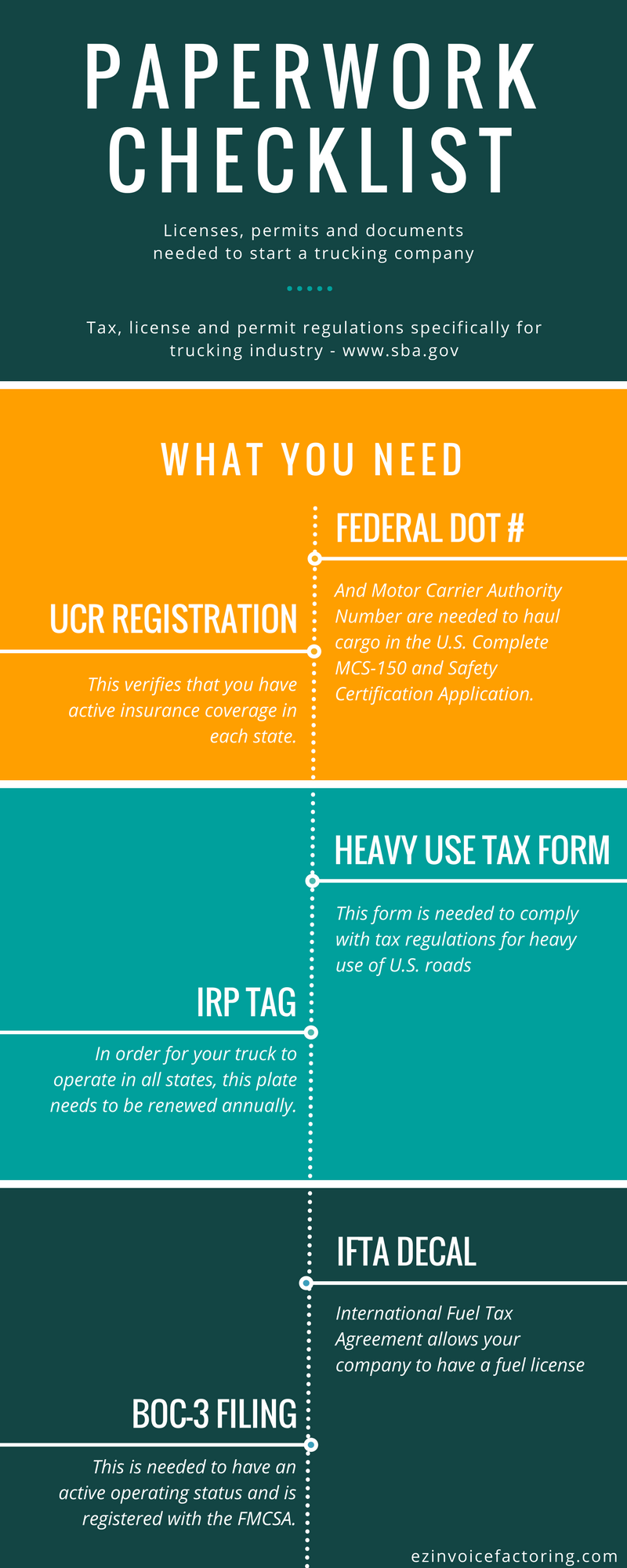

How Do I Get A Ifta Sticker. When you access the link below you will be redirected to our new IFTA online application. Make Sure The Laptop Skin Is Easy To Remove. The licensees base jurisdiction will be the administrator of this agreement and execute all the provisions with respect to the. If your company requires an IFTA license you need to apply in your base state.

Gold Square Outline Border Liked On Polyvore Featuring Frames Borders Backgrounds Outlines Square And Picture Frame Clothes Design Outline Border From pinterest.com

Gold Square Outline Border Liked On Polyvore Featuring Frames Borders Backgrounds Outlines Square And Picture Frame Clothes Design Outline Border From pinterest.com

IFTA-100 – IFTA Quarterly Fuel Tax Report. Carriers who do not wish to participate in the IFTA program must obtain a single trip permit to travel through member jurisdictions. For stubborn stickers lay an alcohol-soaked rag on the area and let it sit for several minutes to soften the residue. You can apply online or print the form and submit it by mail. Each qualified vehicle is required to post 1 decal on each side of the vehicle. IFTA application forms may vary and can sometimes serve other purposes.

If your base jurisdiction is Illinois you must electronically submit Form MFUT-12 Application for Motor Fuel Use Tax IFTA License and Decals using MyTax Illinois to register for motor fuel use tax and receive proper Illinois IFTA credentials.

IFTA-101i – Instructions for Completing IFTA Quarterly Fuel Tax Schedule. The Division contact information is listed below under the. One decal should be placed on each side of your vehicle. IFTA decals are 3 per set. Motor Carrier Road TaxIFTA Forms. This agreement establishes the concept of one fuel use license and one administering base jurisdiction for each licensee.

Source: pinterest.com

Source: pinterest.com

See our contact page for locations. The Division contact information is listed below under the. When you apply for IFTA credentials you will also receive. You may also call 1-800-400-7115 TTY. IFTA Special Fuel User.

Source: pinterest.com

Source: pinterest.com

Have an established place of business in the State from which motor carrier operations are performed mileage must be accrued in your State your. Obtaining an IFTA license and decals are important steps in becoming a successful owner operator. Sample PA IFTA License and Motor Carriers Road Tax Registration Card cab card Decals must be displayed on both sides of the cab of the vehicle. Use the rag to rub off whats left behind. Each qualified vehicle is required to post 1 decal on each side of the vehicle.

Source: in.pinterest.com

Source: in.pinterest.com

After receiving the Maryland IFTA permits a copy must be carried in each. Please be advised when registering. Sample PA IFTA License and Motor Carriers Road Tax Registration Card cab card Decals must be displayed on both sides of the cab of the vehicle. You may also call 1-800-400-7115 TTY. You must file an IFTA Decal Application annually to order a set of 2 decals for each qualified vehicle 10 a set.

Source: pinterest.com

Source: pinterest.com

You must attach one sticker to each side of the vehicles rear in the lower corner. Plus theyll communicate with the FMCSA and DOT until you receive your stickers. Carriers who do not wish to participate in the IFTA program must obtain a single trip permit to travel through member jurisdictions. After receiving the Maryland IFTA permits a copy must be carried in each. However while every effort is made to provide same day service this is not always possible if the number of visitors is high or the carrier is not properly prepared.

Source: pinterest.com

Source: pinterest.com

You must attach one sticker to each side of the vehicles rear in the lower corner. Decals are valid from January 1 to December 31 per year. Carriers based in Ohio for example can use the IFTA application form to request additional decals or make changes to their account. Motor Carrier Office California Department of Tax and Fee Administration 1030 Riverside Parkway Suite 125 West Sacramento CA 95605. Applying for an IFTA license and decals If you need an IFTA license the first step is to fill out the application form used in your base state.

Source: pinterest.com

Source: pinterest.com

For buses please place one sticker on each side no further back than the back of the drivers seat at eye level from the ground. When you apply for IFTA credentials you will also receive. The following forms and information are used for IFTA and Special Fuel Users SFU. Motor Carrier Office California Department of Tax and Fee Administration 1030 Riverside Parkway Suite 125 West Sacramento CA 95605. To purchase your decals complete a Motor Carriers Road TaxIFTA New Account Registration Application IFTA-200A and send it along with your check or money order made payable to PA Department of Revenue to the following address.

Source: pinterest.com

Source: pinterest.com

You may also call 1-800-400-7115 TTY. If your company requires an IFTA license you need to apply in your base state. IFTA decals are 3 per set. When you apply for IFTA credentials you will also receive. 2021 IFTA-400 Q4 – Fourth Quarter 2021 Fuel Tax Rates MCRTIFTA 2021 IFTA-400 Q3 – Third Quarter 2021 Fuel Tax Rates MCRTIFTA.

Source: pinterest.com

Source: pinterest.com

Motor and Alternative Fuel Taxes. If your base jurisdiction is Illinois you must electronically submit Form MFUT-12 Application for Motor Fuel Use Tax IFTA License and Decals using MyTax Illinois to register for motor fuel use tax and receive proper Illinois IFTA credentials. Carriers based in Ohio for example can use the IFTA application form to request additional decals or make changes to their account. The licensees base jurisdiction will be the administrator of this agreement and execute all the provisions with respect to the. Non-exempt vehicles must display IFTA or PA.

Source:

Source:

Likewise do I need a IFTA sticker. You may also call 1-800-400-7115 TTY. Likewise do I need a IFTA sticker. One decal should be placed on each side of your vehicle. Our experts can take care of all paperwork on your behalf.

Source: pinterest.com

Source: pinterest.com

Such decals will be honored in lieu of PA IFTA or PA MCRT decals. If your base jurisdiction is Illinois you must electronically submit Form MFUT-12 Application for Motor Fuel Use Tax IFTA License and Decals using MyTax Illinois to register for motor fuel use tax and receive proper Illinois IFTA credentials. One decal should be placed on each side of your vehicle. Please note that IFTASFU decals are only available at our Salt Lake and Washington County tax offices. Obtaining an IFTA license and decals are important steps in becoming a successful owner operator.

Source: es.pinterest.com

Source: es.pinterest.com

You may also call 1-800-400-7115 TTY. Be sure the information that you enter is complete and accurate. Motor Carrier Office California Department of Tax and Fee Administration 1030 Riverside Parkway Suite 125 West Sacramento CA 95605. When you access the link below you will be redirected to our new IFTA online application. IFTA-101i – Instructions for Completing IFTA Quarterly Fuel Tax Schedule.

Source: pinterest.com

Source: pinterest.com

IFTA-101i – Instructions for Completing IFTA Quarterly Fuel Tax Schedule. Decals are valid from January 1 to December 31 per year. In order to participate in the program you must be registered with the Excise Tax Division as an IFTA or Intrastate Carrier and have an access code which has not expired. To register you must. Complete these two steps.

Source: pinterest.com

Source: pinterest.com

The Division contact information is listed below under the. When the need arises the Bureau of Commercial Vehicle and Driver Services BCVDS Walk-In Service Center in Tallahassee Florida is available to process IFTA forms and payments as well as issue licenses and decals. All decal requests are processed on the next business day and mailed to the address on file. The easiest way to get IFTA stickers or a license is to call our organization. IFTA is an agreement between all the US states except Alaska and Hawaii and most of the provincesterritories of Canada.

Source: in.pinterest.com

Source: in.pinterest.com

Please note that IFTASFU decals are only available at our Salt Lake and Washington County tax offices. License application forms can be found online it differs by each state and are administered by the Department of Transportation for your state tax collection agency or other agency. PA Department of Revenue. IFTA decals are 3 per set. Complete these two steps.

Source: pinterest.com

Source: pinterest.com

To register you must. Our experts can take care of all paperwork on your behalf. Decals are valid from January 1 to December 31 per year. If your base jurisdiction is Illinois you must electronically submit Form MFUT-12 Application for Motor Fuel Use Tax IFTA License and Decals using MyTax Illinois to register for motor fuel use tax and receive proper Illinois IFTA credentials. This agreement establishes the concept of one fuel use license and one administering base jurisdiction for each licensee.

Source: pinterest.com

Source: pinterest.com

After your application has been submitted we will review your application within two weeks. You must attach one sticker to each side of the vehicles rear in the lower corner. The easiest way to get IFTA stickers or a license is to call our organization. When the need arises the Bureau of Commercial Vehicle and Driver Services BCVDS Walk-In Service Center in Tallahassee Florida is available to process IFTA forms and payments as well as issue licenses and decals. To register for the first time as an International Fuel Tax Agreement IFTA licensee in Connecticut you must register with the Department of Revenue Services DRS as a Connecticut business and complete the IFTAMotor Carrier registration through myconneCT.

Source: pinterest.com

Source: pinterest.com

Additionally how do I get my IFTA stickers. If your base jurisdiction is Illinois you must electronically submit Form MFUT-12 Application for Motor Fuel Use Tax IFTA License and Decals using MyTax Illinois to register for motor fuel use tax and receive proper Illinois IFTA credentials. However while every effort is made to provide same day service this is not always possible if the number of visitors is high or the carrier is not properly prepared. Page 43 of 48. Obtaining an IFTA license and decals are important steps in becoming a successful owner operator.

Source: pinterest.com

Source: pinterest.com

Motor Carrier Road TaxIFTA Forms. Additionally how do I get my IFTA stickers. Motor Carrier Office California Department of Tax and Fee Administration 1030 Riverside Parkway Suite 125 West Sacramento CA 95605. IFTA application forms may vary and can sometimes serve other purposes. An IFTA license which should be photocopied and carried in each of your qualified vehicles.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how do i get a ifta sticker by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.