Your Why do you need an ifta sticker images are available. Why do you need an ifta sticker are a topic that is being searched for and liked by netizens today. You can Get the Why do you need an ifta sticker files here. Find and Download all royalty-free photos and vectors.

If you’re looking for why do you need an ifta sticker pictures information linked to the why do you need an ifta sticker keyword, you have visit the ideal blog. Our website always provides you with hints for refferencing the maximum quality video and picture content, please kindly hunt and locate more informative video content and images that match your interests.

Why Do You Need An Ifta Sticker. Where Should I Put My IFTA Decal or Sticker. If your decals are lost damaged or stolen you may order a replacement set of IFTA stickers at an additional cost. You can find the IFTA Governing documents here. First if theyre based in a participating jurisdiction and operate in two or more participating jurisdictions.

What Is Ifta Tax Tax Tax Forms Trucking Business From in.pinterest.com

What Is Ifta Tax Tax Tax Forms Trucking Business From in.pinterest.com

Or Has two axles and a gross vehicle or registered gross vehicle weight of. We take care of the administrative tasks so youll never miss an IFTA deadline and will have more time to drive. Is used in combination and the gross. Why register for IFTA. Commercial motor vehicles are IFTA qualified if they are used designed or maintained for the interstate transportation of persons or property and. The International Fuel Tax Agreement applies to the lower 48 states and 10 Canadian provinces known as member jurisdictions.

We take care of the administrative tasks so youll never miss an IFTA deadline and will have more time to drive.

I cant believe this is a real question. If you own andor operate a commercial truck or fleet that meet IFTA qualifications you will need an IFTA license and decals to display on each vehicle. However you will be required to register for IFTA if any of your qualified IFTA vehicles operate interstate. You can find the IFTA Governing documents here. I cant believe this is a real question. Thats why they are a different color every year so its easy to catch.

Source: pinterest.com

Source: pinterest.com

If you purchase most of your fuel in a state that has low fuel taxes and run most of your miles in states that have higher fuel taxes you will owe taxes to those states with the higher fuel tax rates. You need an IFTA sticker if youre driving a vehicle that Has three or more axles. IFTA was created to simplify the process of recording collecting and disbursing fuel taxes among jurisdictions. Do I need an IFTA license. Carriers need an IFTA license and sticker if they meet two requirements.

Source: pinterest.com

Source: pinterest.com

IFTA defines a qualified motor vehicle as a vehicle built and used to transport property or people. They are obtained through your state or provincial agency. The International Fuel Tax Agreement applies to the lower 48 states and 10 Canadian provinces known as member jurisdictions. This agreement simplifies the process of redistribution of fuel taxes that intrastate carriers pay in different states. If you purchase most of your fuel in a state that has low fuel taxes and run most of your miles in states that have higher fuel taxes you will owe taxes to those states with the higher fuel tax rates.

Source: pinterest.com

Source: pinterest.com

They are obtained through your state or provincial agency. You need an IFTA sticker if youre driving a vehicle that Has three or more axles. For original renewal or temporary decals contact the Michigan Department of Treasury at 517-636-4580. Why should I register for IFTA. Qualified motor vehicles must also fit any of the following descriptions.

Source: pinterest.com

Source: pinterest.com

However you will be required to register for IFTA if any of your qualified IFTA vehicles operate interstate. First if theyre based in a participating jurisdiction and operate in two or more participating jurisdictions. Under IFTA motor carriers file a single quarterly fuel tax report with their base jurisdiction. However you will be required to register for IFTA if any of your qualified IFTA vehicles operate interstate. This agreement simplifies the process of redistribution of fuel taxes that intrastate carriers pay in different states.

Source: pinterest.com

Source: pinterest.com

If you enter California without a valid California Fuel Trip Permit or IFTA credentials you are subject to a penalty. I received a violation for that in the company truck a few years back on an otherwise clean level 1 because the. Carriers that cross more than two state lines must have IFTA licensing. The IFTA report determines the taxes owed or the refund due. We take care of the administrative tasks so youll never miss an IFTA deadline and will have more time to drive.

Source: pinterest.com

Source: pinterest.com

What is IRP. If your vehicle is a commercial motor vehicle used designed or maintained for transportation of persons or property in two or more jurisdictions and either. You have until March 1 of each year before you must carry a current IFTA license. For original renewal or temporary decals contact the Michigan Department of Treasury at 517-636-4580. The International Fuel Tax Agreement IFTA simplifies fuel tax reporting for interstate carriers.

Source: pinterest.com

Source: pinterest.com

As well as to file quarterly reports. You will receive an IFTA quarterly report from your state each quarter to determine if you owe fuel taxes or if you get a fuel tax refund. IFTA or the International Fuel Tax Agreement is an agreement between different US states and Canadian provinces. Another consideration is the type of vehicle they use. You have to the end of February every year to put the current stickers on.

Source: in.pinterest.com

Source: in.pinterest.com

You must then track your mileage in each state or province and keep track of your fuel usage in each. Why register for IFTA. They are obtained through your state or provincial agency. Have two axles and a gross vehicle weight GVW or registered GVW exceeding 26000 pounds. If your decals are lost damaged or stolen you may order a replacement set of IFTA stickers at an additional cost.

Source: pinterest.com

Source: pinterest.com

IFTA stickers require renewal every year. Carriers need an IFTA license and sticker if they meet two requirements. Or Has two axles and a gross vehicle or registered gross vehicle weight of. Why are vehicle validation stickers important. Why register for IFTA.

Source: pinterest.com

Source: pinterest.com

IFTA or the International Fuel Tax Agreement is an agreement between different US states and Canadian provinces. We take care of the administrative tasks so youll never miss an IFTA deadline and will have more time to drive. If youre like most truckers the idea of keeping up with due dates and paperwork is more than you want to deal with. This is if you have applied on time to renew your IFTA license and your account is in good standing. During January and February of each year a valid IFTA license and decals from the previous year will be honored by.

Source: pinterest.com

Source: pinterest.com

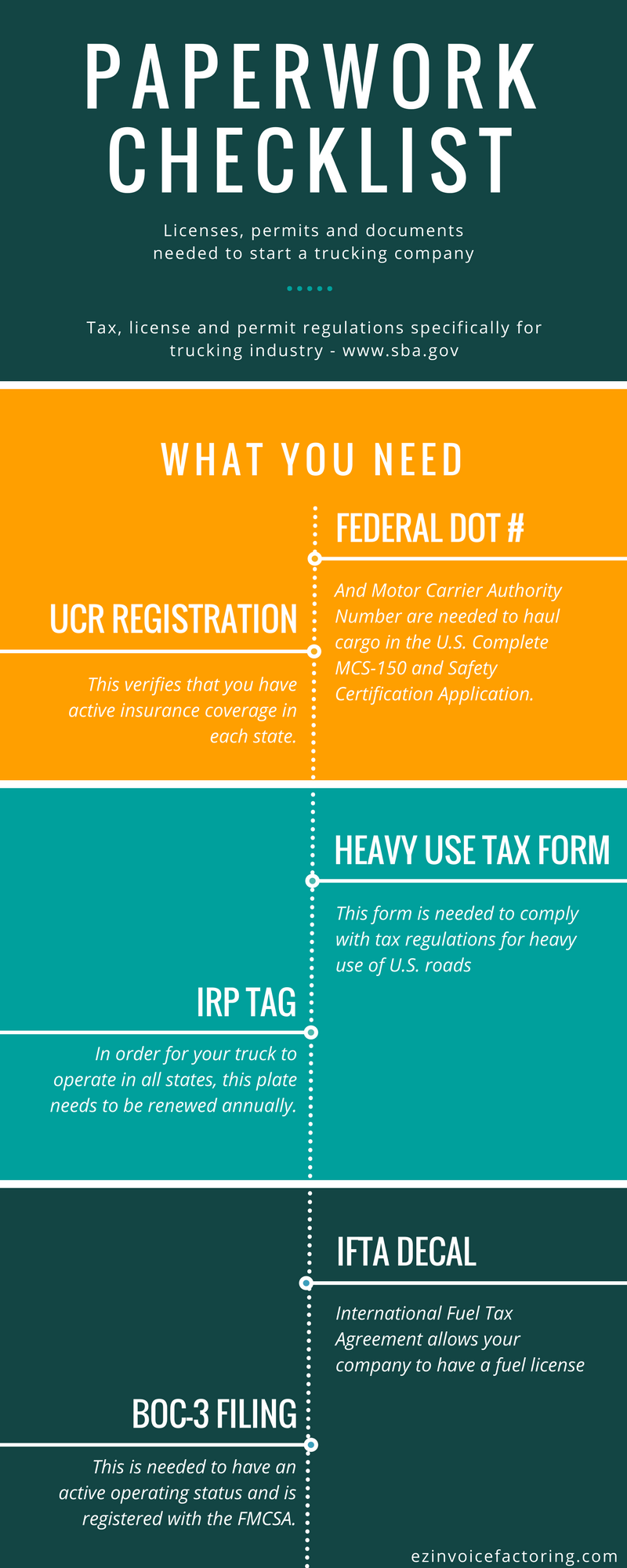

Having one IFTA licence to allow travel in all member jurisdictions and dealing with one jurisdiction for the reporting and payment of motor fuel taxes. If you drive your truck for interstate commerce you are required to have an International Fuel Tax Act IFTA decal. In addition the role of the IFTA stickers is to allow your vehicles to travel to any jurisdiction by a qualified vehicle. What is IRP. Once a carrier has an IFTA license and decals reporting can begin.

Source: pinterest.com

Source: pinterest.com

What is IRP. Having one IFTA licence to allow travel in all member jurisdictions and dealing with one jurisdiction for the reporting and payment of motor fuel taxes. What is IFTA. Thats why its important that we dont lose sight of the role vehicle validation stickers play in not just road safety but also public safety. If your vehicle s qualifies and operates in more than one IFTA jurisdiction you must obtain a license and IFTA decals which allow you to travel between member jurisdictions.

Source: pinterest.com

Source: pinterest.com

These benefits include one license one set of decals one quarterly fuel tax report that reflects the net tax or refund due. If youre like most truckers the idea of keeping up with due dates and paperwork is more than you want to deal with. If you purchase most of your fuel in a state that has low fuel taxes and run most of your miles in states that have higher fuel taxes you will owe taxes to those states with the higher fuel tax rates. The IFTA report determines the taxes owed or the refund due. The scales and rovers do notice this.

Source: pinterest.com

Source: pinterest.com

First if theyre based in a participating jurisdiction and operate in two or more participating jurisdictions. If you enter California without a valid California Fuel Trip Permit or IFTA credentials you are subject to a penalty. As well as to file quarterly reports. You need an IFTA sticker if youre driving a vehicle that Has three or more axles. Carriers that cross more than two state lines must have IFTA licensing.

Source: pinterest.com

Source: pinterest.com

Who needs an IFTA sticker. For original renewal or temporary decals contact the Michigan Department of Treasury at 517-636-4580. IFTA stickers require renewal every year. IFTA or the International Fuel Tax Agreement is an agreement between different US states and Canadian provinces. Who needs an IFTA sticker.

Source: in.pinterest.com

Source: in.pinterest.com

For original renewal or temporary decals contact the Michigan Department of Treasury at 517-636-4580. They also have to display their current IFTA decals. This agreement simplifies the process of redistribution of fuel taxes that intrastate carriers pay in different states. What is IRP. Thats why you need TruckingOffice.

Source: pinterest.com

Source: pinterest.com

Under IFTA motor carriers file a single quarterly fuel tax report with their base jurisdiction. If your decals are lost damaged or stolen you may order a replacement set of IFTA stickers at an additional cost. Commercial motor vehicles are IFTA qualified if they are used designed or maintained for the interstate transportation of persons or property and. IFTA or the International Fuel Tax Agreement is an agreement between different US states and Canadian provinces. This agreement simplifies the process of redistribution of fuel taxes that intrastate carriers pay in different states.

Source: pinterest.com

Source: pinterest.com

Why should I register for IFTA. If you travel in an IFTA jurisdiction without valid IFTA credentials or a fuel trip permit you may be subject to a penalty fine or citation depending on the jurisdictions laws. Compliance is a more streamlined and consolidated process than ever before. IFTA reports help determine how much fuel tax is owed in each state or province based on the miles driven in each jurisdiction. Thats why they are a different color every year so its easy to catch.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title why do you need an ifta sticker by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.